| View previous topic :: View next topic |

| Author |

Message |

Former Arlingtonian

Joined: 23 Oct 2013

Posts: 141

|

|

| Back to top |

|

|

Guest

|

Posted: Sun Jan 08, 2017 2:26 am GMT Post subject: Posted: Sun Jan 08, 2017 2:26 am GMT Post subject: |

|

|

I was reading that 1989 newspaper image, and I see 30 year fixed mortgage rate was 11%. And I see house selling for $300,000. I remember the minimum wage was $4.75 back then.

Looks like the bubble back then is way bigger then what we have today before it burst. Is that mean the current bubble still have room to grow for a while? |

|

| Back to top |

|

|

Former Arlingtonian

Joined: 23 Oct 2013

Posts: 141

|

Posted: Mon Jan 09, 2017 2:10 pm GMT Post subject: Better economy in 1989 Posted: Mon Jan 09, 2017 2:10 pm GMT Post subject: Better economy in 1989 |

|

|

In 1989 the USA was just ending the biggest boom since post WWII and the economy was on much better footings than today.

But, no one can really guess how big a bubble will get - human psychology is impossible to predict. |

|

| Back to top |

|

|

guest

Guest

|

Posted: Mon Jan 09, 2017 5:43 pm GMT Post subject: Re: Better economy in 1989 Posted: Mon Jan 09, 2017 5:43 pm GMT Post subject: Re: Better economy in 1989 |

|

|

| Former Arlingtonian wrote: | In 1989 the USA was just ending the biggest boom since post WWII and the economy was on much better footings than today.

But, no one can really guess how big a bubble will get - human psychology is impossible to predict. |

In the last two major bubbles, the price to rent ratio in Boston hit around 40 before the bubble popped. We are getting closer. SF has already started deflating.

https://smartasset.com/mortgage/price-to-rent-ratio-in-us-cities |

|

| Back to top |

|

|

Guest

Guest

|

Posted: Thu Jan 12, 2017 2:15 am GMT Post subject: Posted: Thu Jan 12, 2017 2:15 am GMT Post subject: |

|

|

| The 1980s boom was fueled by massive government spending. Peacetime debt like we had never seen before. In 1989 we were on the brink of the George HW Bush recession. |

|

| Back to top |

|

|

Former Arlingtonian

Joined: 23 Oct 2013

Posts: 141

|

Posted: Fri Jan 13, 2017 1:50 pm GMT Post subject: INTEREST RATES - 1980s Posted: Fri Jan 13, 2017 1:50 pm GMT Post subject: INTEREST RATES - 1980s |

|

|

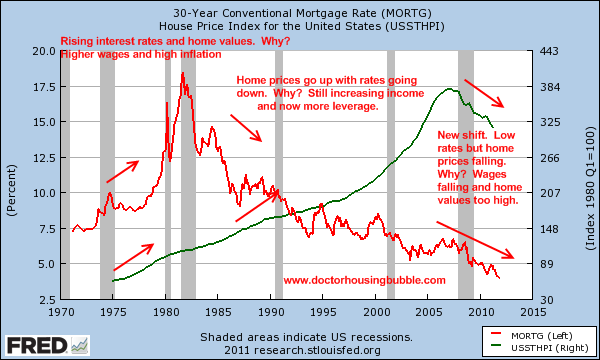

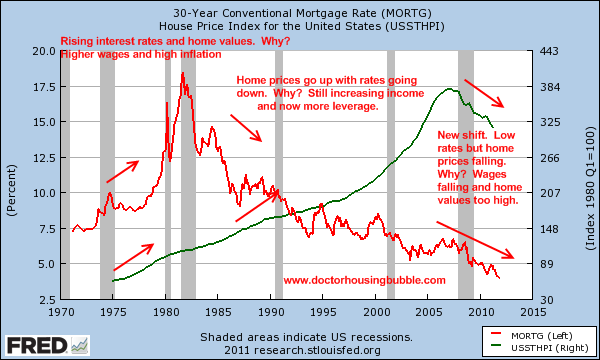

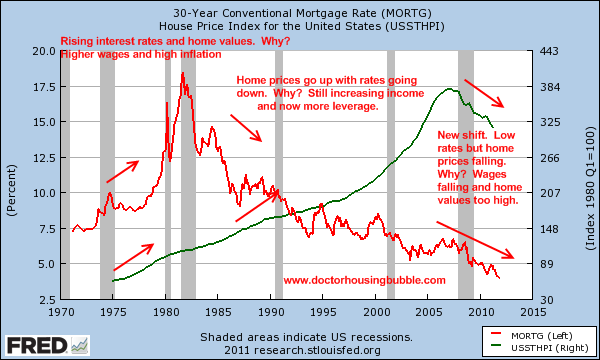

In the 1980s effective Federal Reserve Funds rate (borrowing cost for Banks) fell fro 19% to 5% .

Falling Interest rates causes Assets to spike in value as money can be borrow to buy things ......and it gets cheaper...cheaper ....cheaper to refinance or borrow more.

|

|

| Back to top |

|

|

Guest

Guest

|

Posted: Sat Jan 14, 2017 8:15 pm GMT Post subject: Re: INTEREST RATES - 1980s Posted: Sat Jan 14, 2017 8:15 pm GMT Post subject: Re: INTEREST RATES - 1980s |

|

|

| Former Arlingtonian wrote: |

In the 1980s effective Federal Reserve Funds rate (borrowing cost for Banks) fell fro 19% to 5% .

Falling Interest rates causes Assets to spike in value as money can be borrow to buy things ......and it gets cheaper...cheaper ....cheaper to refinance or borrow more.

|

If you expand the graph to 200 years, you will see that historic rates for past 150 years are usually under 5%. The double digit rates in 70s and 80s were an aberration that you will never see in your lifetime again.

http://www.businessinsider.com/10-year-us-treasury-note-yield-since-1790-2012-6 |

|

| Back to top |

|

|

Guest

|

Posted: Sun Jan 15, 2017 1:36 am GMT Post subject: Posted: Sun Jan 15, 2017 1:36 am GMT Post subject: |

|

|

| Quote: | | In the 1980s effective Federal Reserve Funds rate (borrowing cost for Banks) fell fro 19% to 5% |

What I am interesting to find out was those historical reasons of why and how FED rate being dropped from 19% to 5%, and why and how the FED rate being jack back up to burst the bubble at 1989.

I was too young to care about it back then. |

|

| Back to top |

|

|

Former Arlingtonian

Joined: 23 Oct 2013

Posts: 141

|

Posted: Sun Jan 15, 2017 3:54 am GMT Post subject: Posted: Sun Jan 15, 2017 3:54 am GMT Post subject: |

|

|

1970s - Inflation gets out of control - after Nixon closes the Gold window for international settlements - assuring tax payers citizens that it will usher in an era of prosperity:

https://www.youtube.com/watch?v=7_Xw5tWsOQo

Inflation rages through the 1970s.

Paul Volker is put in charge of Federal Reserve - and raises Federal Funds rate the get inflation under control:

https://www.youtube.com/watch?v=zuDxOHN44gQ

When the Fed reduces Federal Funds rate and real estate / all assets take off/ the economy is revive and economy booms.

The Fed Reserve starts the raise interest rates to contain inflation and reign in the economy. Ultimately, the Federal Reserves rate rises causes the economy and real estate to stall. |

|

| Back to top |

|

|

Guest

|

Posted: Mon Jan 16, 2017 2:06 am GMT Post subject: Posted: Mon Jan 16, 2017 2:06 am GMT Post subject: |

|

|

| Quote: | | The Fed Reserve starts the raise interest rates to contain inflation and reign in the economy. Ultimately, the Federal Reserves rate rises causes the economy and real estate to stall. |

The Fed is in the similar situation now, we need to see how it will raise rate to contain inflation in the years to come. From my point of view, inflation are extremely bad for the past few years, but largely focus in 3 areas, which are, education cost, healthcare cost and housing cost. Food price went up, but gas price went down to balance it out. The Fed has intentionally ignored the situation, and let inflation go wild with QE and prolong ultra low interest rate. The purpose is to keep the economy engine running.

Let's see if the FED could do a fantastic balancing job, or it is creating a slow economic trainwreck. |

|

| Back to top |

|

|

Former Arlingtonian

Joined: 23 Oct 2013

Posts: 141

|

Posted: Mon Jan 16, 2017 3:16 am GMT Post subject: Fuel cost vs Food Posted: Mon Jan 16, 2017 3:16 am GMT Post subject: Fuel cost vs Food |

|

|

Even when gasoline was high my family spends a much bigger portion of our income on food than on gasoline. Food bill can run $300 per week and gasoline savings from oil crash is approximately $60 per week

- fees for child recreation/sports up

- trash collection up

- water/sewer fees up

-clothing cost up

-rent/house purchase up dramatically

-property taxes up |

|

| Back to top |

|

|

bugelrex

Joined: 24 Feb 2009

Posts: 16

|

Posted: Mon Jan 16, 2017 3:24 am GMT Post subject: Posted: Mon Jan 16, 2017 3:24 am GMT Post subject: |

|

|

| The proposed 1 trillion stimulus could support the bubble for at least a few more years! Especially if it really does improve the transportation infrastructure |

|

| Back to top |

|

|

|