|

bostonbubble.com

Boston Bubble - Boston Real Estate Analysis

|

|

SPONSORED LINKS

Advertise on Boston Bubble

Buyer brokers and motivated

sellers, reach potential buyers.

www.bostonbubble.com

YOUR AD HERE

|

|

DISCLAIMER: The information provided on this website and in the

associated forums comes with ABSOLUTELY NO WARRANTY, expressed

or implied. You assume all risk for your own use of the information

provided as the accuracy of the information is in no way guaranteed.

As always, cross check information that you would deem useful against

multiple, reliable, independent resources. The opinions expressed

belong to the individual authors and not necessarily to other parties.

|

| View previous topic :: View next topic |

| Author |

Message |

unlawflcombatnt

Joined: 02 Aug 2005

Posts: 13

|

Posted: Sun Mar 26, 2006 8:51 pm GMT Post subject: Housing Market Declining Rapidly Posted: Sun Mar 26, 2006 8:51 pm GMT Post subject: Housing Market Declining Rapidly |

|

|

HOUSING MARKET DECLINING RAPIDLY

Friday's New Home Sales report added further evidence that the housing market is declining. Monthly New Home Sales showed the biggest decline in 9 years. The decline in New Home Sales was larger than the real estate mythologists predicted. The annualized New Home Sales rate declined 10.5% during the last month. (Technically, if 0 new homes had been sold during the last month, the annualized sales rate would have only declined 1/12th, or 8.3%. So some previously sold homes must have become "un-sold.") January's number was also revised downward. Had January's number not been revised, the decline would have been 12.5%. The annual New Home Sales rate has declined 21% since July. Median annual prices also declined to a -2.9% annualized rate of increase. Inventories increased from 5.3 months' worth to 6.3 months' in February.

Since October's peak in New Home Sales of 1.345 million/year, the rate has declined to 1.080 million/year. Unsold inventories of New Homes have risen 4 of the last 5 months, from 4.5 months worth in October to 6.3 months' worth in February. The unsold inventory of New Homes is the highest in 10 years according to Briefing.com Over the past year, there has been a 24% increase in new homes on the market, according to CNN Money.

Also, according to CNN Money, the current median price for a new home is now $230,400. This is down $6,900 from February 2005. In addition, the current median New Home Price is down 5.5% from October's $243,900.

In some areas the decline was much larger. In the West, the 1-month decline in the annualized New Home Sales rate was 30%, declining from 357,000/year to 252,000/year. In the West, the annual New Home Sales rate has declined 49% from its October peak of 410,000/year. This information can be found at Briefing.com New Home Sales

EXISTING HOME SALES

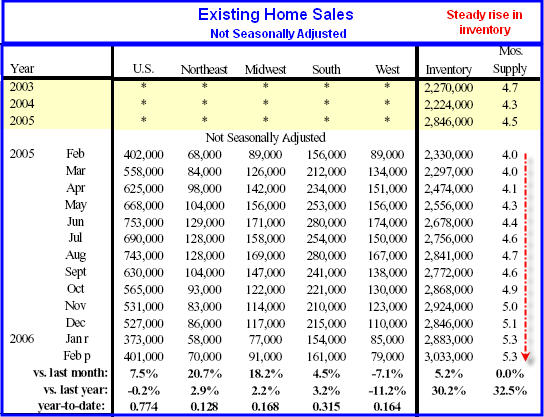

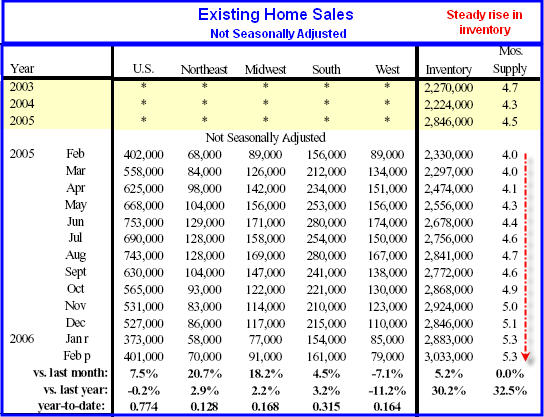

The Existing Home Sales report from Thursday, March 23rd, was reported with unjustified opitimism. The seasonally adjusted sales rate actually declined from the previous year. February 2006's annualized rate was 6.190 million/year, marking a -0.3% change from February 2005's 6.930 million/year rate. Meanwhile, Existing home inventories INCREASED 5.2% over the last month, and increased 30.2% over the last year. Below are charts from HoweStreet.com showing these changes.

Once again, the declining numbers are even more extreme in the West, especially in California. Existing home sales dropped 15.5% from the same period 1 year ago. The inventory of unsold Existing Homes in Calfornia is now 6.7 months' worth, compared to 3.2 months' worth a year ago (from the Orange County Register.) In Orange County, California, there are currently 10.4 months' worth of unsold inventory of Existing Homes, compared to 5.7 months' worth a year ago. The median price of existing homes in California declined 2.9% from January 2006.

The Mortgage Bankers' Association purchase index also declined dramatically. The 4-week Purchase Index moving average has declined from 470 in October to 401.5 at present.

In summary, both New and Existing Home Sales are declining, with New Home Sales declining much more. Meanwhile, inventories are rising rapidly in both New and Existing Homes. The biggest inventory increases and sales declines are in bubble areas, especially California. Prices are actually declining in some areas, most notably Southern California. Housing Starts actually increased over the last month, which will increase inventories even further, and put further downward pressure on home prices.

The Housing Bubble is definitely deflating, and appears to be deflating even faster than many predicted.

unlawflcombatnt

EconomicPopulistCommentary

Economic Patriot Forum

_________________

The economy needs balance between the "means of production" & "means of consumption." |

|

| Back to top |

|

|

admin

Site Admin

Joined: 14 Jul 2005

Posts: 1826

Location: Greater Boston

|

Posted: Mon Mar 27, 2006 10:28 pm GMT Post subject: Posted: Mon Mar 27, 2006 10:28 pm GMT Post subject: |

|

|

unlawflcombatnt,

Thanks for another great post. I've linked to it from the main page.

- admin |

|

| Back to top |

|

|

unlawflcombatnt

Joined: 02 Aug 2005

Posts: 13

|

|

| Back to top |

|

|

|

|

You can post new topics in this forum

You can reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

|

Forum posts are owned by the original posters.

Forum boards are Copyright 2005 - present, bostonbubble.com.

Privacy policy in effect.

Powered by phpBB © 2001, 2005 phpBB Group

|