|

bostonbubble.com

Boston Bubble - Boston Real Estate Analysis

|

|

SPONSORED LINKS

Advertise on Boston Bubble

Buyer brokers and motivated

sellers, reach potential buyers.

www.bostonbubble.com

YOUR AD HERE

|

|

DISCLAIMER: The information provided on this website and in the

associated forums comes with ABSOLUTELY NO WARRANTY, expressed

or implied. You assume all risk for your own use of the information

provided as the accuracy of the information is in no way guaranteed.

As always, cross check information that you would deem useful against

multiple, reliable, independent resources. The opinions expressed

belong to the individual authors and not necessarily to other parties.

|

| View previous topic :: View next topic |

| Author |

Message |

bugelrex

Joined: 24 Feb 2009

Posts: 16

|

Posted: Sat Feb 04, 2017 5:46 pm GMT Post subject: What to do if you can't wait for the bubble to pop Posted: Sat Feb 04, 2017 5:46 pm GMT Post subject: What to do if you can't wait for the bubble to pop |

|

|

We should discuss what folks who cannot wait should do.

We all know the bubble will bust one day but for a variety of reasons ppl cannot wait it out:

More kids in the way, better school system, peer pressure etc

Ideas if you have to bite the bullet

For the best value :

Don't buy places with new kitchen/bathroom. The current market will jack up the valuation of the house. Sweat equity to fix kitchen bathroom or live in it while sourcing cheaper contractors

Try to buy largest backyard as possible, the land will buoy your price during a downturn. Possible to expand home as the house u bought it likely small. So not forced to sell in a downturn due to lack of space

Priority should b school system, parents become less logical and more emotional to move their kids into a good school system

It's going to b a fixer upper. No way around this

Only use 30 year fixed, the risk/reward does not make sense for anything else |

|

| Back to top |

|

|

Guest

|

Posted: Sat Feb 04, 2017 10:07 pm GMT Post subject: Posted: Sat Feb 04, 2017 10:07 pm GMT Post subject: |

|

|

| Code: | Don't buy places with new kitchen/bathroom. The current market will jack up the valuation of the house. Sweat equity to fix kitchen bathroom or live in it while sourcing cheaper contractors

Try to buy largest backyard as possible, the land will buoy your price during a downturn. Possible to expand home as the house u bought it likely small. So not forced to sell in a downturn due to lack of space

Priority should b school system, parents become less logical and more emotional to move their kids into a good school system

It's going to b a fixer upper. No way around this

Only use 30 year fixed, the risk/reward does not make sense for anything else |

I agree school system is very important factor. But there are many towns now a day calling itself's school system top of the line. Be very careful on those 'nice-want-to-be' towns out there.

From my point of view, a good school system, beside good teachers and large town resource, The biggest forming factor is the kids, with parents who are willing to invest more than average times and resources to their own kids. And in general these are higher income parents who can afford more expensive houses. so as long as you can afford buying in those price level, you are good. Don't expect good school system on towns that seem to be affordable. Enough said on this, go do your own homework. I also agree to take 30 year fixed, that is just a no brainier.

I disagree on pretty much the rest. Here is my point of view. If you pay attention to home owner behavior, you should know people willing to do renovation during the up market, as they can extract equity easily, and they feel the money they paid actually reflected right back on the increase home value. And almost no one will renovate housing when home price is going down hill. So if you buy a shitty house at the top of the market, and price went south, and if you get into negative equity, you most likely will not put more money into your house. Then you stuck with a shitty home to live in, and a shitty home that will not sell.

I hold my view as, if you had to buy today, try to go all the way out, get as nice of a house as you could at the best of location you could afford, while interest rate still low, lock in the rate. I am not suggesting you to try buying house beyond your affordability, you can always rent and wait. But if you had to buy, don't go cheap on the hot market, as a 'deal' in this market usually represent the crap shack that will not retain its value if housing bubble pop. Same idea of a big back yard. Yes it allows you to expand, but if the housing bubble pop, it will be just a bare yard for you, as most likely you will have no resource or willingness to expand your house. |

|

| Back to top |

|

|

Guest

|

Posted: Sat Feb 04, 2017 10:07 pm GMT Post subject: Posted: Sat Feb 04, 2017 10:07 pm GMT Post subject: |

|

|

| Code: | Don't buy places with new kitchen/bathroom. The current market will jack up the valuation of the house. Sweat equity to fix kitchen bathroom or live in it while sourcing cheaper contractors

Try to buy largest backyard as possible, the land will buoy your price during a downturn. Possible to expand home as the house u bought it likely small. So not forced to sell in a downturn due to lack of space

Priority should b school system, parents become less logical and more emotional to move their kids into a good school system

It's going to b a fixer upper. No way around this

Only use 30 year fixed, the risk/reward does not make sense for anything else |

I agree school system is very important factor. But there are many towns now a day calling itself's school system top of the line. Be very careful on those 'nice-want-to-be' towns out there.

From my point of view, a good school system, beside good teachers and large town resource, The biggest forming factor is the kids, with parents who are willing to invest more than average times and resources to their own kids. And in general these are higher income parents who can afford more expensive houses. so as long as you can afford buying in those price level, you are good. Don't expect good school system on towns that seem to be affordable. Enough said on this, go do your own homework. I also agree to take 30 year fixed, that is just a no brainier.

I disagree on pretty much the rest. Here is my point of view. If you pay attention to home owner behavior, you should know people willing to do renovation during the up market, as they can extract equity easily, and they feel the money they paid actually reflected right back on the increase home value. And almost no one will renovate housing when home price is going down hill. So if you buy a shitty house at the top of the market, and price went south, and if you get into negative equity, you most likely will not put more money into your house. Then you stuck with a shitty home to live in, and a shitty home that will not sell.

I hold my view as, if you had to buy today, try to go all the way out, get as nice of a house as you could at the best of location you could afford, while interest rate still low, lock in the rate. I am not suggesting you to try buying house beyond your affordability, you can always rent and wait. But if you had to buy, don't go cheap on the hot market, as a 'deal' in this market usually represent the crap shack that will not retain its value if housing bubble pop. Same idea of a big back yard. Yes it allows you to expand, but if the housing bubble pop, it will be just a bare yard for you, as most likely you will have no resource or willingness to expand your house. |

|

| Back to top |

|

|

bugelrex

Joined: 24 Feb 2009

Posts: 16

|

Posted: Sun Feb 05, 2017 1:53 am GMT Post subject: Posted: Sun Feb 05, 2017 1:53 am GMT Post subject: |

|

|

Guest,

What you are saying is logical, however in a bubble 90% of people are thinking the same. Buy the best house you can possibly afford. This leads to bidding wars and overpaying more than you should.

It's very agonizing because with these low rates, if you find a "forever house" (can live in for the next 20, 30 years) then it's really hard not to try stretch for it. No matter anyone's stance on the bubble, in 30 years the house will not loose value simply because of inflation |

|

| Back to top |

|

|

Former Arlingtonian

Joined: 23 Oct 2013

Posts: 141

|

|

| Back to top |

|

|

Guest

|

Posted: Sun Feb 05, 2017 6:21 am GMT Post subject: Posted: Sun Feb 05, 2017 6:21 am GMT Post subject: |

|

|

| Quote: | | It's very agonizing because with these low rates, if you find a "forever house" (can live in for the next 20, 30 years) then it's really hard not to try stretch for it. No matter anyone's stance on the bubble, in 30 years the house will not loose value simply because of inflation |

Yes, as a home owner, you are only the loser, if you being forced to short sell or give up your home, due to inability to pay for the mortgage. As long as you could wait out the housing down turn, the last overpaid price will eventually become the current bargain price 20 years after.

The current market is un-affordable, in some areas, even getting the crap shack is stretching, so getting a dream house is extremely stretching. Which means you got bigger chance of defaulting, if housing bubble burst. Need to evaluate your ability to retain your home during housing down turn, before you get into buying mode. |

|

| Back to top |

|

|

Guest

|

Posted: Sun Feb 05, 2017 1:34 pm GMT Post subject: Posted: Sun Feb 05, 2017 1:34 pm GMT Post subject: |

|

|

Former Arlingtonian, one thing I have reserves on this type of analysis based on data statistic, is its inability to calculate trend with future income inflation that could reduce the level of the un-affordability at current income to home price.

I think this is the biggest unknown factor that define when the current housing bubble is going to pop.

For the last 15 years, we've seen stagnate income in US due to globalization. While recent inflation trend was picking up rapidly since 2010, due to QE and ultra low rate. current U.S. Inflation concentrated in main areas such as housing, healthcare and education(daycare, private school and college cost), so B.S. analysis excluded those and keep fooling the general public with low inflation term, to justify the Ultra low FED rate policy.

Now come the protectionism from trump, with promoting of getting jobs back to the US. I believe in the long run disconnecting from the world will hurt us, as no country will do better in the long run by locking itself up. But in the short run(next 5 years), it could well boost the U.S. economy, as well as income level. Especially the massive infrastructure upgrade plan, will definitely help job and income and general INFLATION in the board level in the next few years. If all these could finally allow people to demand higher salary, then it could catch up and justify the current high home price. But again, it could also not working the direction trump's admin team think, and lead to inflation in ALL area with salary still not catching up.

It is a plan, and it require careful and well executed balancing act. It is too early to tell if this will be a success or a bust yet. We need to pay extra attention to this, in order to predict the future behavior of current housing bubble, instead of blandly trusting some charts based on past data and objective thinking. |

|

| Back to top |

|

|

Guest

|

Posted: Sun Feb 05, 2017 2:31 pm GMT Post subject: Re: Read this analysis before you buy Posted: Sun Feb 05, 2017 2:31 pm GMT Post subject: Re: Read this analysis before you buy |

|

|

One interesting things about that article, the charts at the bottom show that Boston faired relatively well during housing bubble 1.0 (compared to other locales)

Dallas looks kinda scary, is it a crazy bubble or did Dallas pick up a sh*t load of real jobs? |

|

| Back to top |

|

|

Former Arlingtonian

Joined: 23 Oct 2013

Posts: 141

|

Posted: Sun Feb 05, 2017 5:44 pm GMT Post subject: Biotech and Tech bubble redux Posted: Sun Feb 05, 2017 5:44 pm GMT Post subject: Biotech and Tech bubble redux |

|

|

Key phrase to listen to from graphic is:

“what all of these markets have in common is they are either primarily driven by tech and biotech sectors, both of which are arguably in generational bubbles right now.”

[img]https://static1.squarespace.com/static/569fce7adf40f315de772b61/t/56bbd67c62cd94f5f8c1a51d/1455150720668/[/img]

Biotech boom started in Boston area just as the Tech wreck had hit bottom - a simultaneous Biotech bust and tech wreck will impact Boston area dramatically. |

|

| Back to top |

|

|

Guest

|

Posted: Tue Feb 07, 2017 12:28 am GMT Post subject: Re: Biotech and Tech bubble redux Posted: Tue Feb 07, 2017 12:28 am GMT Post subject: Re: Biotech and Tech bubble redux |

|

|

| Former Arlingtonian wrote: | Key phrase to listen to from graphic is:

“what all of these markets have in common is they are either primarily driven by tech and biotech sectors, both of which are arguably in generational bubbles right now.”

Biotech boom started in Boston area just as the Tech wreck had hit bottom - a simultaneous Biotech bust and tech wreck will impact Boston area dramatically. |

Pharma giants like Novartis, Pfizer, Sanofi, Takeda etc. have joined the biotechs (Biogen, Amgen) in Cambridge. These companies are very profitable sporting products with fairly inelastic demand. Cambridge is also the home to Google, Microsoft, and Facebook outposts. In my opinion, it is pure hyperbole to compare the current tech valuation to the bubble that occurred in the late 90s ("generational"), and I also do not believe the valuations of pharma, though high, can be equated to that era. Moreover, the area is diversified with higher education, government, finance, etc.

The transformation over the past two decades has been pretty astounding. Parking lots are now towers housing thousands of high-paying jobs. The area around Kendall and Seaport continue to be slated for additional large, commercial projects. These are not filled with startups, but rather by fortune 50 companies.

Sure, we could have another massive recession in the near future. That can be said and pretty much any point in time. With that mindset, one would always rent (which is a fine choice)... |

|

| Back to top |

|

|

Guest

|

Posted: Tue Feb 07, 2017 12:45 am GMT Post subject: Re: Biotech and Tech bubble redux Posted: Tue Feb 07, 2017 12:45 am GMT Post subject: Re: Biotech and Tech bubble redux |

|

|

| Former Arlingtonian wrote: | Key phrase to listen to from graphic is:

“what all of these markets have in common is they are either primarily driven by tech and biotech sectors, both of which are arguably in generational bubbles right now.”

[img]https://static1.squarespace.com/static/569fce7adf40f315de772b61/t/56bbd67c62cd94f5f8c1a51d/1455150720668/[/img]

Biotech boom started in Boston area just as the Tech wreck had hit bottom - a simultaneous Biotech bust and tech wreck will impact Boston area dramatically. |

The biotech bubble will pop when we move to a single payer system or get rid of drug patents. The tech wreck will happen when we stop using computers and smart phones. I think the world will be taken over skynet before either happens. |

|

| Back to top |

|

|

Former Arlingtonian

Joined: 23 Oct 2013

Posts: 141

|

Posted: Tue Feb 07, 2017 12:58 am GMT Post subject: I love the belief Posted: Tue Feb 07, 2017 12:58 am GMT Post subject: I love the belief |

|

|

I love the hard core belief in real estate and biotech.

Can anyone name a single real estate boom that didn't end in tears and misery...........waiting.

Sadly, a boom like we have lived through 1999 -2017 is a once in a generation event.

Please tell me a 50 year period that didn't have a massive wipe out of real estate.  This real estate wipe out will make 2007-2009 look like fun when it finally happens. This real estate wipe out will make 2007-2009 look like fun when it finally happens.

I think we should respectfully agree to disagree. |

|

| Back to top |

|

|

Guest

|

Posted: Tue Feb 07, 2017 1:14 pm GMT Post subject: Re: I love the belief Posted: Tue Feb 07, 2017 1:14 pm GMT Post subject: Re: I love the belief |

|

|

| Former Arlingtonian wrote: | I love the hard core belief in real estate and biotech.

Can anyone name a single real estate boom that didn't end in tears and misery...........waiting.

Sadly, a boom like we have lived through 1999 -2017 is a once in a generation event.

Please tell me a 50 year period that didn't have a massive wipe out of real estate.  This real estate wipe out will make 2007-2009 look like fun when it finally happens. This real estate wipe out will make 2007-2009 look like fun when it finally happens.

I think we should respectfully agree to disagree. |

To be fair, the current boom is 2011 - 2017

Almost every bubble pop is followed by a recovery. I can only think of Japan's RE bubble which has not recovered after 30 years

Tech and bio bubble pop does not mean they go away. It shifts the supply and demand so the outcome is lower salaries and higher unemployment. So perhaps top earners will take a 30% pay cut and average works 15% with no pay increases for several years?

It's really hard to say if prices would fall below the 2009 bottom in Boston. Even the top towns with the best a school districts saw a 20 to 30% dip from peak and because those towns had a higher percentage of looooooooong time home owners they were able to keep afloat |

|

| Back to top |

|

|

Former Arlingtonian

Joined: 23 Oct 2013

Posts: 141

|

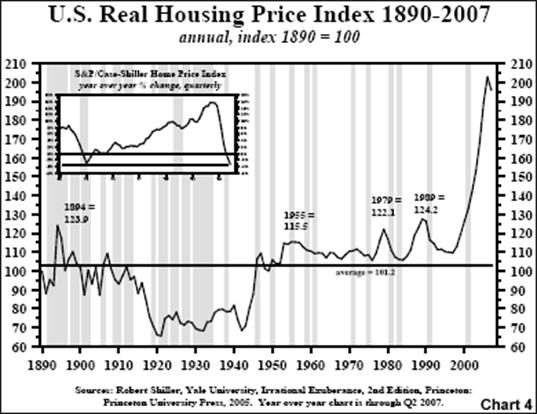

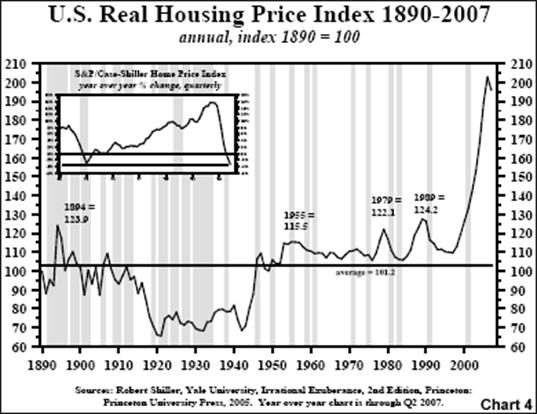

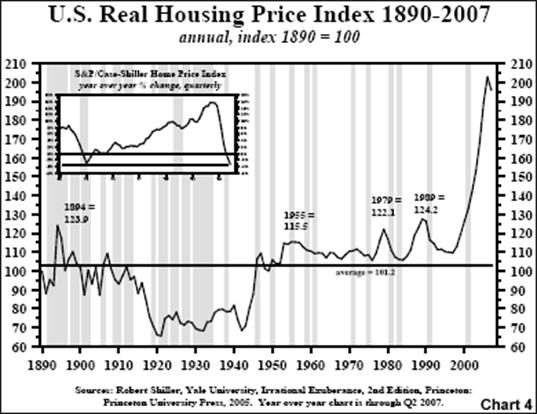

Posted: Tue Feb 07, 2017 1:37 pm GMT Post subject: Take a look at historical prices - this boom is biggest EVER Posted: Tue Feb 07, 2017 1:37 pm GMT Post subject: Take a look at historical prices - this boom is biggest EVER |

|

|

Sorry but financial history indicates you are dreaming if you think the next pull back is 20%

|

|

| Back to top |

|

|

Guest

|

Posted: Tue Feb 07, 2017 4:22 pm GMT Post subject: Re: Take a look at historical prices - this boom is biggest Posted: Tue Feb 07, 2017 4:22 pm GMT Post subject: Re: Take a look at historical prices - this boom is biggest |

|

|

| Former Arlingtonian wrote: | Sorry but financial history indicates you are dreaming if you think the next pull back is 20%

|

Only regional charts are relevant. The last bubble pop in 2009, I would have said the same thing.. Only a 20% pullback, no way! At least 50%... But taking Newton, MA as an example, it only pulled back about 20% from peak

The question is, will the next pop pull it down back to 2009 levels or will it again only be a 20% drop from peak in prime locations.

Now multi family units I can see dropping like stones if the rates increase, the investment return comparison between rental income and simply sitting on CD would make buying a multi family for rental absolutely pointless |

|

| Back to top |

|

|

|

|

You can post new topics in this forum

You can reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

|

Forum posts are owned by the original posters.

Forum boards are Copyright 2005 - present, bostonbubble.com.

Privacy policy in effect.

Powered by phpBB © 2001, 2005 phpBB Group

|