|

bostonbubble.com

Boston Bubble - Boston Real Estate Analysis

|

|

SPONSORED LINKS

Advertise on Boston Bubble

Buyer brokers and motivated

sellers, reach potential buyers.

www.bostonbubble.com

YOUR AD HERE

|

|

DISCLAIMER: The information provided on this website and in the

associated forums comes with ABSOLUTELY NO WARRANTY, expressed

or implied. You assume all risk for your own use of the information

provided as the accuracy of the information is in no way guaranteed.

As always, cross check information that you would deem useful against

multiple, reliable, independent resources. The opinions expressed

belong to the individual authors and not necessarily to other parties.

|

| View previous topic :: View next topic |

| Author |

Message |

Former Arlingtonian

Joined: 23 Oct 2013

Posts: 141

|

Posted: Fri Jan 06, 2017 7:01 pm GMT Post subject: Posted: Fri Jan 06, 2017 7:01 pm GMT Post subject: |

|

|

| Anonymous wrote: | | Quote: | | The hardest thing to do is to just wait. |

Simply seat and wait is not the answer.

As when home price went south, usually economy will go south as well. Yet during mean time, interest rate and difficulty level of getting the loan will go higher.

I will say if you were able to buy, and have to buy now, buy properties in good location(good school, convenient location to work, quite environment etc) .

When crap hits the fan, your home will goes down in value, but won't fall like a stone as other crappy properties that seems like a 'deal' at current market condition.

If you are not able to settle in 1 location for a while, then rent.

If you could not afford it, then it is simple, you are forced to wait anyway. |

WRONG, WRONG, WRONG.

My family can buy and we are choosing to wait. It isn't easy - it feels like the hardest thing you can do most days and then you think about familes destroyed by the last RE market collapse!

You have no idea how well a good town's real estate values will hold up or how your income or renters will hold up!

I realize I'm offering unorthodox advice - but we have never seen mortgage/ interest rates this low for this long. There is no way to know what will be the unintended problems when the busts sets in and yes every real estate boom ends with a massive/painful bust that feels like it will NEVER end.

WAIT! |

|

| Back to top |

|

|

Guest

|

Posted: Fri Jan 06, 2017 7:47 pm GMT Post subject: Posted: Fri Jan 06, 2017 7:47 pm GMT Post subject: |

|

|

| Anonymous wrote: | | Quote: | | The hardest thing to do is to just wait. |

Simply seat and wait is not the answer.

As when home price went south, usually economy will go south as well. Yet during mean time, interest rate and difficulty level of getting the loan will go higher.

I will say if you were able to buy, and have to buy now, buy properties in good location(good school, convenient location to work, quite environment etc) .

When crap hits the fan, your home will goes down in value, but won't fall like a stone as other crappy properties that seems like a 'deal' at current market condition.

If you are not able to settle in 1 location for a while, then rent.

If you could not afford it, then it is simple, you are forced to wait anyway. |

I agree, that makes sense. |

|

| Back to top |

|

|

Guest

|

Posted: Fri Jan 06, 2017 10:01 pm GMT Post subject: Posted: Fri Jan 06, 2017 10:01 pm GMT Post subject: |

|

|

| Quote: | | You have no idea how well a good town's real estate values will hold up or how your income or renters will hold up! |

Former Arlingtonian, no one has a fortune telling ball that could tell what is going to happen next. But we could do things that minimize the damage.

Buying in top areas is the most defensive move in current housing market actually, if you have to buy.

The rental demand is always there for those good area, especially when private school cost is skyrocketing for the past 10 years, It re-defines the price floor of rental income on property in area with good public school system, and conveniently located within city commute radius. I know price will drop if economy go bad; Or interest rate go "WAY" up. but on the long run, price goes up, at least on money term. Please also be aware of during the economic down turn, it could be similarly difficult to buy the house you want, due to the fact that income source is at risk, and banks are not willing to lend.

I am not saying waiting is bad idea currently, I am just trying to make people aware that your purchase ability change alone with economic condition. You need to have the resource and courage and necessary knowledge to time the market.

People who is waiting, should ask themselves Why didn't they buy between 2010 to 2012 period? This is not meant to be as a insult, but rather a question to help you understand your investment style.

I am sure it will help you to decide if you should buy or wait once you do some deep soul searching. |

|

| Back to top |

|

|

Guest

Guest

|

Posted: Fri Jan 06, 2017 10:48 pm GMT Post subject: Posted: Fri Jan 06, 2017 10:48 pm GMT Post subject: |

|

|

| Anonymous wrote: | | Quote: | | You have no idea how well a good town's real estate values will hold up or how your income or renters will hold up! |

Former Arlingtonian, no one has a fortune telling ball that could tell what is going to happen next. But we could do things that minimize the damage.

Buying in top areas is the most defensive move in current housing market actually, if you have to buy.

The rental demand is always there for those good area, especially when private school cost is skyrocketing for the past 10 years, It re-defines the price floor of rental income on property in area with good public school system, and conveniently located within city commute radius. I know price will drop if economy go bad; Or interest rate go "WAY" up. but on the long run, price goes up, at least on money term. Please also be aware of during the economic down turn, it could be similarly difficult to buy the house you want, due to the fact that income source is at risk, and banks are not willing to lend.

I am not saying waiting is bad idea currently, I am just trying to make people aware that your purchase ability change alone with economic condition. You need to have the resource and courage and necessary knowledge to time the market.

People who is waiting, should ask themselves Why didn't they buy between 2010 to 2012 period? This is not meant to be as a insult, but rather a question to help you understand your investment style.

I am sure it will help you to decide if you should buy or wait once you do some deep soul searching. |

They didn't buy in 2010 to 2012 because they were waiting for prices to go lower. I know someone who has been waiting on the sidelines since 2003 and is still convinced he's right. |

|

| Back to top |

|

|

Guest

|

Posted: Fri Jan 06, 2017 11:09 pm GMT Post subject: Posted: Fri Jan 06, 2017 11:09 pm GMT Post subject: |

|

|

| Quote: | | They didn't buy in 2010 to 2012 because they were waiting for prices to go lower. I know someone who has been waiting on the sidelines since 2003 and is still convinced he's right. |

Not necessary. If you could not settle then, you couldn't buy. If you lost your income source, then you couldn't buy. Similar reasons are perfectly OK. |

|

| Back to top |

|

|

Former Arlingtonian

Joined: 23 Oct 2013

Posts: 141

|

Posted: Sat Jan 07, 2017 4:32 am GMT Post subject: insane mortgage rates Posted: Sat Jan 07, 2017 4:32 am GMT Post subject: insane mortgage rates |

|

|

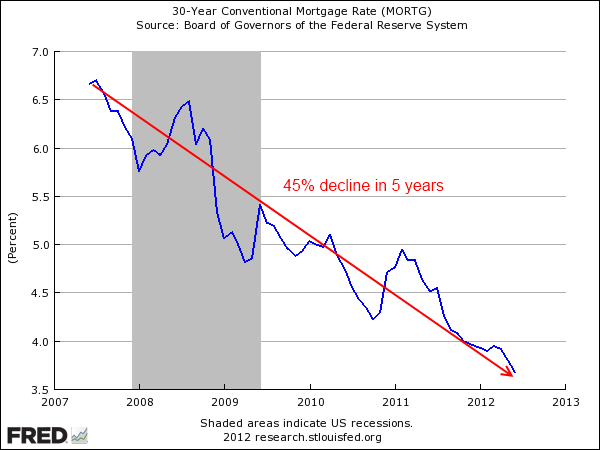

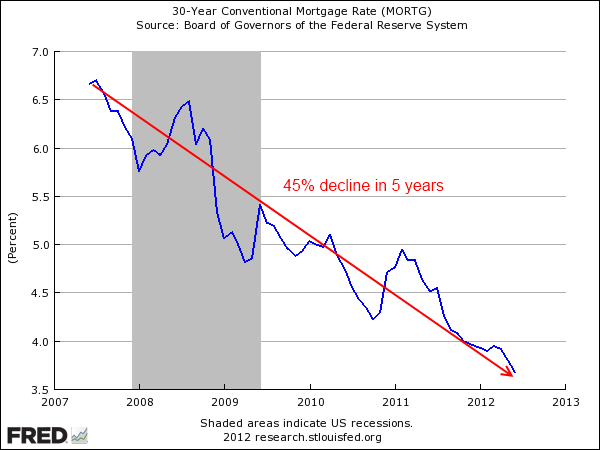

5000 year low in interest rates get you

Sorry but we have never been here before and no one has a clue how this will turn out, and its always great to say go ahead buy a home in that good neighborhood everything will work out. Sorry but it takes insane discipline to say I'm going to sit this one out.

Read up on Issac Newton - very good in math. He got out of his investment in South Sea Co - only to buy back in because everyone own South Sea Co stock - even the British Government - and then the unforeseen happen and Poor Issac was broke - completely wiped out!

Best to all. |

|

| Back to top |

|

|

Guest

|

Posted: Sat Jan 07, 2017 1:47 pm GMT Post subject: Posted: Sat Jan 07, 2017 1:47 pm GMT Post subject: |

|

|

The most important thing to consider, is how to prevent short sell of your property during the down time of the market.

You are only the loser, when you are forced to sell your own home below the price you paid. So if you were weak at income source, beware.

look back the past 30 years, you will see even if you brought at the top of the housing bubble in 1989, 2000, 2007, as long as you can stay put, give it 8 to 10 years, you usually will regain all your equity. You regain all equity very quickly if you brought in good areas. This is the fact no one can deny.

of course if you were smart enough to wait until 1993, 2003, 2010, and you still had the money and willing to bite the bullet, then you made a killing! |

|

| Back to top |

|

|

Guest

Guest

|

Posted: Sun Jan 15, 2017 3:40 am GMT Post subject: Posted: Sun Jan 15, 2017 3:40 am GMT Post subject: |

|

|

| I've been following this board for over ten years now. To the best of my recollection, during the whole time noone has ever thought it was a good time to buy a home. |

|

| Back to top |

|

|

bugelrex

Joined: 24 Feb 2009

Posts: 16

|

Posted: Mon Jan 16, 2017 3:17 am GMT Post subject: Posted: Mon Jan 16, 2017 3:17 am GMT Post subject: |

|

|

| Quote: |

They didn't buy in 2010 to 2012 because they were waiting for prices to go lower. I know someone who has been waiting on the sidelines since 2003 and is still convinced he's right. |

Your friend is correct, what happened is that fed kept rates too low then and certainly too low now. He assumed a normal market without fed artificial rates.

The only way to avoid a crash is increasing the rate over a period of 8 years and hope inflation or wages 'mask' the monthly payments at 7% 30 year fixed. 7% is historically low but would decimate the housing market now right |

|

| Back to top |

|

|

bugelrex

Joined: 24 Feb 2009

Posts: 16

|

Posted: Mon Jan 16, 2017 3:19 am GMT Post subject: Posted: Mon Jan 16, 2017 3:19 am GMT Post subject: |

|

|

| Guest wrote: | | I've been following this board for over ten years now. To the best of my recollection, during the whole time noone has ever thought it was a good time to buy a home. |

Good time to buy:

Mortgage (30yr fixed with 20% down) = mortgage |

|

| Back to top |

|

|

bugelrex

Joined: 24 Feb 2009

Posts: 16

|

Posted: Mon Jan 16, 2017 3:21 am GMT Post subject: Posted: Mon Jan 16, 2017 3:21 am GMT Post subject: |

|

|

| bugelrex wrote: | | Guest wrote: | | I've been following this board for over ten years now. To the best of my recollection, during the whole time noone has ever thought it was a good time to buy a home. |

Good time to buy:

Mortgage (30yr fixed with 20% down) = mortgage |

Sorry I meant rent!

GOOD TIME TO BUY:

Mortgage (30yr fixed with 20% down) = RENT |

|

| Back to top |

|

|

Guest

|

Posted: Sat Jan 21, 2017 12:52 am GMT Post subject: Posted: Sat Jan 21, 2017 12:52 am GMT Post subject: |

|

|

| bugelrex wrote: | | bugelrex wrote: | | Guest wrote: | | I've been following this board for over ten years now. To the best of my recollection, during the whole time noone has ever thought it was a good time to buy a home. |

Good time to buy:

Mortgage (30yr fixed with 20% down) = mortgage |

Sorry I meant rent!

GOOD TIME TO BUY:

Mortgage (30yr fixed with 20% down) = RENT |

Except you also get a tax break on the interest and at these low rates a significant portion of the payment goes to principal... |

|

| Back to top |

|

|

Guest

|

Posted: Sun Jan 22, 2017 12:47 am GMT Post subject: Posted: Sun Jan 22, 2017 12:47 am GMT Post subject: |

|

|

| Guest wrote: | | I've been following this board for over ten years now. To the best of my recollection, during the whole time noone has ever thought it was a good time to buy a home. |

Buddy, you are on the wrong forum. Most of the people here are renters who have been hoping for the past 10 years for the bubble to pop. Renters are clueless when it comes to buying a home.

FYI, the best time to buy is after a recession when unemployment peaks at 9%-10% and starts to go down, like from 2010-2012. Now at record low 4% unemployment is not a good time to buy. |

|

| Back to top |

|

|

Guest

Guest

|

Posted: Sun Jan 22, 2017 4:28 pm GMT Post subject: Posted: Sun Jan 22, 2017 4:28 pm GMT Post subject: |

|

|

Why does a low unemployment rate indicate a bad time to buy? Isn't low unemployment associated with job security?

And job insecurity was often cited as a reason not to buy during the unemployment years. |

|

| Back to top |

|

|

admin

Site Admin

Joined: 14 Jul 2005

Posts: 1826

Location: Greater Boston

|

Posted: Mon Jan 23, 2017 2:32 pm GMT Post subject: Posted: Mon Jan 23, 2017 2:32 pm GMT Post subject: |

|

|

| Guest wrote: | Why does a low unemployment rate indicate a bad time to buy? Isn't low unemployment associated with job security?

And job insecurity was often cited as a reason not to buy during the unemployment years. |

Low unemployment only helps immediate term job security. Long term, your job isn't more secure. So if most people are buying as if the current unemployment rate represents their permanent job security, you are competing with people who are overextending during periods of low unemployment, as opposed to less competition when unemployment is high.

- admin |

|

| Back to top |

|

|

|

|

You can post new topics in this forum

You can reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

|

Forum posts are owned by the original posters.

Forum boards are Copyright 2005 - present, bostonbubble.com.

Privacy policy in effect.

Powered by phpBB © 2001, 2005 phpBB Group

|