|

bostonbubble.com

Boston Bubble - Boston Real Estate Analysis

|

|

SPONSORED LINKS

Advertise on Boston Bubble

Buyer brokers and motivated

sellers, reach potential buyers.

www.bostonbubble.com

YOUR AD HERE

|

|

DISCLAIMER: The information provided on this website and in the

associated forums comes with ABSOLUTELY NO WARRANTY, expressed

or implied. You assume all risk for your own use of the information

provided as the accuracy of the information is in no way guaranteed.

As always, cross check information that you would deem useful against

multiple, reliable, independent resources. The opinions expressed

belong to the individual authors and not necessarily to other parties.

|

| View previous topic :: View next topic |

| Author |

Message |

Teavo

Guest

|

Posted: Tue Feb 24, 2009 6:16 pm GMT Post subject: Re: Last of the Knife-Catchers Posted: Tue Feb 24, 2009 6:16 pm GMT Post subject: Re: Last of the Knife-Catchers |

|

|

| melonrightcoast wrote: | | Teavo wrote: | | Patience has been, and will continue to be, rewarded. |

I hope you are right. I REALLY hope you are right. But that turns all us would-be-buyers into Believers. Believers that we should be paying no more than 3x annual income for a decent SFH. Unfortunately, we have our government, the banks, and our society, against us. So, even though I want to Believe, I am a realist, and I doubt that it will happen because of government intervention. |

I hear you! I wish the government would realize that lower house prices are the solution, not the problem.

Try as they might, the government can't put the bubble back together again. Real estate market forces are bigger than the government. All they can do is slow down the crash, and not even by very much. It only serves to extend the pain for everyone, but eventually we get to the same place - cheaper real estate (see Japan in the 1990's).

Note that I say "cheaper" real estate. The rule of thumb of 3x annual income doesn't always apply to "popular" places, even in down times. IIRC, in my town the ratio got as high as 7x or 8x at the height of the bubble which was flat-out ridiculous, and it's come down significantly since then. But that doesn't mean it will drop all the way to 3x, especially when interest rates are low as they are now. Was it as low as 3x in the real-estate bust of the early 1990s here in the Boston area? I'm not sure but I don't think it got quite that low.

(On the slip side, look at a place like Detroit - I think it's something like 1x or even less there! But for sadly obvious reasons.)

I'm not saying Boston won't go to 3x. The "hot" label moves from city to city over time, and economies rise and fall. All I'm saying is that it might not go that low in the near future. Perhaps, say, 4x is "reasonable" for Boston if the job market doesn't fall too hard, and people still want to live here more than in the average city. Those are big "ifs" though.

Anyway, we're probably around 5x right now, so things are still too expensive, but prices continue to fall. So the only question is where you decide to set your threshold for fair value. We're clearly not there yet, but moving in the right direction. Personally, I'm going to give it at least 1-2 more years before seriously looking at buying. |

|

| Back to top |

|

|

JCK

Joined: 15 Feb 2007

Posts: 559

|

Posted: Tue Feb 24, 2009 6:26 pm GMT Post subject: Re: Last of the Knife-Catchers Posted: Tue Feb 24, 2009 6:26 pm GMT Post subject: Re: Last of the Knife-Catchers |

|

|

| admin wrote: | | How much control does the government really have? They can drag out the correction and mask its magnitude with inflation, but what else? |

I agree. I watched the Frontline special last week on the meltdown. It went through the Bear Stearns bailout, and the Lehman collapse.

In the Bear Stearns case, the markets lost confidence when the government intervened. In the Lehman case, the markets lost confidence because the government didn't intervene.

So I agree, at this point, the government has very little control. The market systems fail when people lose confidence in them, and there's little that can be done.

I think the $70B or so is mostly a show that the government won't sit by and do nothing. But I don't think Obama or anyone else is under the illusion that the housing "assistance" is going to be silver bullet. |

|

| Back to top |

|

|

melonrightcoast

Joined: 22 Feb 2009

Posts: 236

Location: metrowest

|

Posted: Tue Feb 24, 2009 6:55 pm GMT Post subject: Re: Last of the Knife-Catchers Posted: Tue Feb 24, 2009 6:55 pm GMT Post subject: Re: Last of the Knife-Catchers |

|

|

| JCK wrote: | | admin wrote: | | How much control does the government really have? They can drag out the correction and mask its magnitude with inflation, but what else? |

I agree. I watched the Frontline special last week on the meltdown. It went through the Bear Stearns bailout, and the Lehman collapse.

In the Bear Stearns case, the markets lost confidence when the government intervened. In the Lehman case, the markets lost confidence because the government didn't intervene.

So I agree, at this point, the government has very little control. The market systems fail when people lose confidence in them, and there's little that can be done.

I think the $70B or so is mostly a show that the government won't sit by and do nothing. But I don't think Obama or anyone else is under the illusion that the housing "assistance" is going to be silver bullet. |

Hmmm. So we wait. And hope. I just wish it didn't appear that the government WANTS to keep prices high, and that they will force banks to lend money to homeowners by relaxing the current lending requirements because now they are "too strict", in order to keep housing prices high.

I know I sound like a broken record... but I am getting tired of waiting.

Additionally, I'm wondering if the "Spring Bounce" that we see in Boston is due to all the first time home buyers that are stuck in too small apartments all winter. An extreme version of retail therapy, if you will  . .

_________________

melonrightcoast ... are you? |

|

| Back to top |

|

|

StallionMang

Joined: 29 Apr 2008

Posts: 54

|

Posted: Tue Feb 24, 2009 7:38 pm GMT Post subject: Posted: Tue Feb 24, 2009 7:38 pm GMT Post subject: |

|

|

This is a very timely topic, as my wife's nesting instinct is coming on strong - john p, you're right about that

I see two reasons to keep waiting:

1) Unemployment is rising. This will reduce supply and increase demand. No way around it. Unemployment leads housing prices.

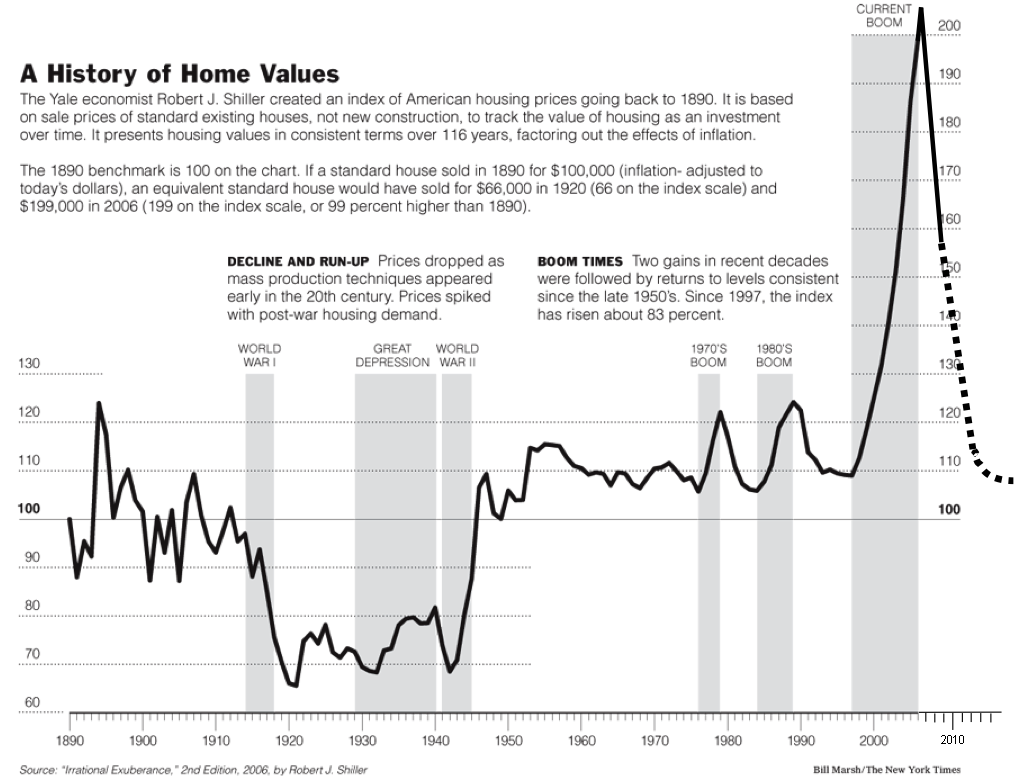

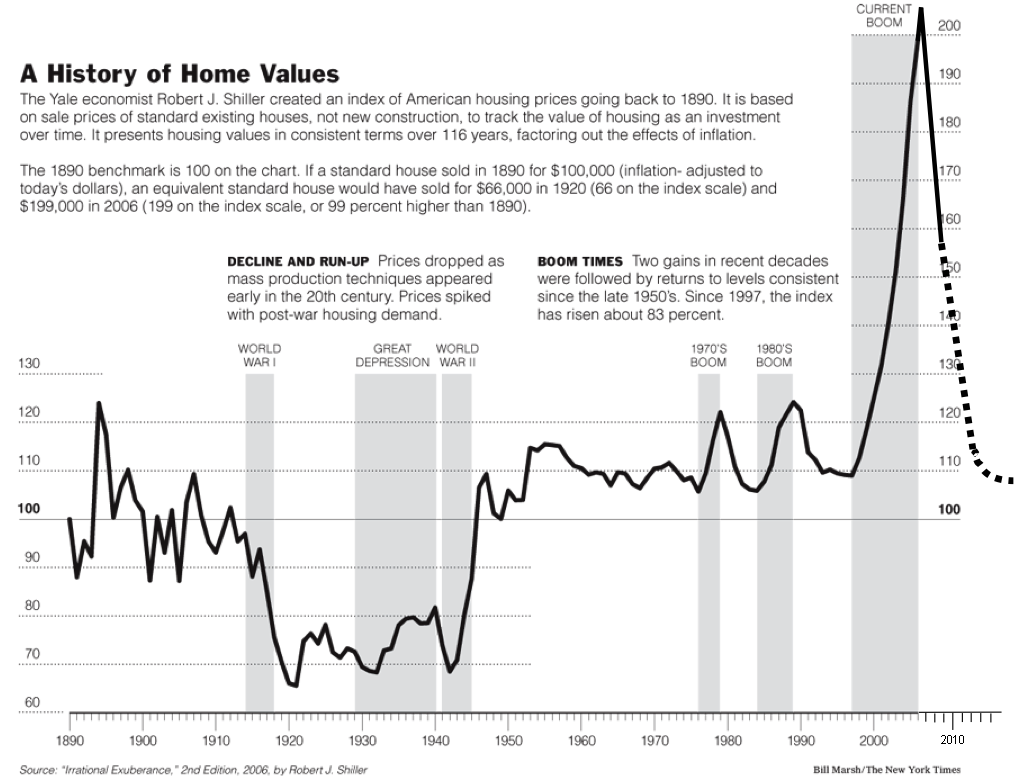

2) Historical housing prices - there is a lot of downside for prices to come down to a reasonable level. Talk about a falling knife!

I was talking to a colleague who is in Ireland -- and still owns a home in the US. He convinced his wife to rent. Now they are moving and she is VERY glad they rented. |

|

| Back to top |

|

|

melonrightcoast

Joined: 22 Feb 2009

Posts: 236

Location: metrowest

|

Posted: Tue Feb 24, 2009 9:25 pm GMT Post subject: nesting and housing, continued Posted: Tue Feb 24, 2009 9:25 pm GMT Post subject: nesting and housing, continued |

|

|

| StallionMang wrote: |

1) Unemployment is rising. This will reduce supply and increase demand. No way around it. Unemployment leads housing prices.

|

Did you mean rising unemployment will simultaneously increase the supply of homes and reduce the demand for them? And that unemployment rates and housing prices are indirectly proportional to each other (ie rising unemployment=falling housing prices)?

_________________

melonrightcoast ... are you? |

|

| Back to top |

|

|

john p

Joined: 10 Mar 2006

Posts: 1820

|

Posted: Tue Feb 24, 2009 9:46 pm GMT Post subject: Posted: Tue Feb 24, 2009 9:46 pm GMT Post subject: |

|

|

StallionMag:

I don't see anything unusual in that chart you posted. Nothing seems out of the norm.

Am I missing something? |

|

| Back to top |

|

|

GenXer

Joined: 20 Feb 2009

Posts: 703

|

Posted: Wed Feb 25, 2009 12:19 pm GMT Post subject: Posted: Wed Feb 25, 2009 12:19 pm GMT Post subject: |

|

|

To play the devil's advocate here, but there is no theory which supports the assumption that prices have to return to normal, or that prices do so in a dramatic fashion. Some facts

1) We have not observed 'reversion to the mean' in the data for the stock market or real estate prices.

http://homepage.mac.com/j.norstad/finance/rtm-and-forecasting.html#rtm

2) Our sample set is too small (even 100 years may be too small!) to be able to correctly predict what will happen in the future to prices with any reasonable degree of accuracy

http://www.fooledbyrandomness.com/central.pdf

Conclusion: I can draw up any chart I like - it will look convincing, but it is nothing more than a guess, a RANDOM guess at that, because it is not based on any kind of mathematical theory.

Take most of these 'predictions' with a grain of salt and don't bet any money on it. We may or may not get lower prices in the future. I think it will probably happen, but HOW exactly or when, or even if - these are questions only time will answer. |

|

| Back to top |

|

|

JCK

Joined: 15 Feb 2007

Posts: 559

|

Posted: Wed Feb 25, 2009 2:21 pm GMT Post subject: Posted: Wed Feb 25, 2009 2:21 pm GMT Post subject: |

|

|

| GenXer wrote: |

Conclusion: I can draw up any chart I like - it will look convincing, but it is nothing more than a guess, a RANDOM guess at that, because it is not based on any kind of mathematical theory.

Take most of these 'predictions' with a grain of salt and don't bet any money on it. We may or may not get lower prices in the future. I think it will probably happen, but HOW exactly or when, or even if - these are questions only time will answer. |

Exactly. Be skeptical of all people making predictions. IF it were four years ago, and that chart was going up, would it be good prediction that prices would keep going up?

We really don't know what going to happen, although I don't expect any increases in the next few months.

If you're seriously in the market to buy, I think the key is laying low and tracking some places. See how long they stay on the market and see how much they sell for. Then you can get a good sense of what is and what is not a good deal. |

|

| Back to top |

|

|

Teavo

Guest

|

Posted: Wed Feb 25, 2009 2:50 pm GMT Post subject: Posted: Wed Feb 25, 2009 2:50 pm GMT Post subject: |

|

|

Your argument that "we can't know the future" is one that I've often seen trotted out by real estate bulls when they don't know what else to say in the face of overwhelming evidence of a grave bear market.

Of course nobody knows what will happen in the future. That applies to everything: real estate, sports, politics, and quantum mechanics (well, OK, maybe except for death and taxes).

That doesn't mean we cannot make reasonable estimates and predictions that we can expect are more likely to be correct than the random flip of a coin.

For example, I don't know that I'll get through the day without being hit by lightning or winning the lottery. But I am 99% sure.

I don't know that the housing market will continue to go down. But I am 99% sure.

The current global real estate/credit bubble is the largest in recorded world history, which is a pretty sizable sample. Every single bubble in that time has followed the same pattern and so far this one is no different. Does that mean we "know" it will play out as all the previous bubbles? No, because maybe a giant meteor will strike our planet today and change everything. Hey, it could happen. But otherwise, I think we can be pretty sure that bubbles are bubbles, that they rise high, then crash hard. And that's what's happening now.

I'm afraid that your "don't bet money on it" advice is impossible to follow. If you buy a house, you're "betting money" that prices will rise. And if you don't buy a house you're betting money that prices will fall. No matter what a person does or does not do, it's effectively a bet on housing prices, either up or down.

So we do the best we can with the evidence we have available. It's a lot better than passively throwing up one's hands and leaving it to fate. |

|

| Back to top |

|

|

JCK

Joined: 15 Feb 2007

Posts: 559

|

Posted: Wed Feb 25, 2009 3:27 pm GMT Post subject: Posted: Wed Feb 25, 2009 3:27 pm GMT Post subject: |

|

|

No. You misunderstand my argument. My argument is primarily that drawing lines on a graph is a terrible, terrible way to make a prediction. That's why I absolutely despise those sorts of graphs. Please draw a graph with the last five years removed, draw a similar line (based on the five years before that) and tell me how predictive that line is.

There are many reasons to believe prices will drop in the near future, and I'm not arguing against that premise. I am arguing, however, that these sorts of graphs have no predictive value whatsoever, and only serve to mislead, rather than educate.

You don't know how quickly or slowly prices are going to decline, even if we accept that they are. That graph implies that we have some idea of the timeframe or the extent of the decline, which we simply do not. |

|

| Back to top |

|

|

Boston ITer

Guest

|

Posted: Wed Feb 25, 2009 3:40 pm GMT Post subject: Posted: Wed Feb 25, 2009 3:40 pm GMT Post subject: |

|

|

| Quote: | | melonrightcoast: Could that happen to Boston? Maybe. I think people like it here too much, though. Do people like Buffalo? That was one blaring contrast between Philadelphia and Boston that I noticed. People living in and near Philly didn't like it. They thought it was a crappy place to live. |

Well honestly, since young Buffalonians grow up with snow, I think the answer is yes. It's one of the friendliest 1 million metro areas but the problem is that when one graduates from let's say SUNY/Buffalo, one has to move to find work. In a sense, those people who'd stayed behind are folks who're in govt and/or in that semi-retired lifestyle. And the word is that it's a great place to grow up (and live in) but there are no jobs. I'd even worked with a few Buffalonians, in a midwestern project, who'd said that many of their older friends were planning on retiring there.

In contrast, since the 70s, no one's liked Philly; it's always had this Detroit of the northeast corridor type of visage, with unsafe neighborhoods and lots of random muggings and violence; kinda like the New York of the mid 70s/early 80s, if you've ever seen that movie about the subway Guardian Angels. The nice metro areas, like the whole King of Prussia to Mainline zone, had practically disowned the city. And for much of that region, from Cherry Hill NJ to KoP PA to Delaware, the companies are sprawled all over the place and not central to Philly, itself.

What I believe is making this occur is the critical density between NYC and DC, where there's essentially a continuous urban/suburban sprawl along i-95 and associated highways. It's a type of eastern version of Southern Cal.

| Quote: | | GenXer: 'smart' people don't always make smart financial decisions, so it wouldn't matter if they wanted to live in Boston. Right now, a lot of high income jobs have been cut - in software, in biotech research, in engineering and now in higher education. This may be just a start of a big unemployment wave. Salaries are also being cut. |

Part of the crux of my argument is the seismic change going on in eastern MA. The areas which had created high paying work is vanishing; you see it everywhere and now, it's even in higher ed, an area once considered untouchable for Boston. All and all, seismic changes is what changed Buffalo from the 20th century's new Great Lakes city to that of a rust belt. Likewise, seismic changes could also do the same thing to Boston where in a sense, everyone will be struggling to get into the govt, from an earlier age, or else, move some place else for work. Now, like certain Buffalonians, I'd like to retire locally, however, I don't suspect that Boston will be a low crime metropolitan area, once the money leaves and hence, I'm targeting Northern Vermont. |

|

| Back to top |

|

|

john p

Joined: 10 Mar 2006

Posts: 1820

|

Posted: Wed Feb 25, 2009 3:40 pm GMT Post subject: Posted: Wed Feb 25, 2009 3:40 pm GMT Post subject: |

|

|

My theory relates to the properties of the market.

For example, by the FED flooding the money supply and the multiplier of wealth that goes along with that, he has deformed the fundamentals.

For example, if water is in the form of ice it has structural properties, you can walk across it and go fishing. If it heats up you can't walk on it unless you're Obama. It de-formed, changed form, changed state from one state that had a set of properties to another that has another state of properties.

That "specific heat" of when a material changes properties differs from one price point and one seller/ buyer to another. Certainly this economic situation has changed the properties of the situation. I know a Chartered Financial Anaylist that is sweating his job this very day. He's got like 25 years experience so his "solid standing" is now a little slushy. I pray to God he keeps his job as he is a sole earner and has two kids and a wife that was diagnosed with Breast Cancer. If you're the praying type, maybe do a shout out for this guy and many others in a similar deal...

This specific heat is sometimes hard to detect, I mean Bernanke didn't see the meltdown of many of the banks until it got up and close this past September. Knowing Alt-A's are coming and understanding the stresses and strains on the system give you a sense of the pressure of things but think about how all the fundamentals pointed to a recession in 07 and things held out till mid 08, I believe that was the amount of heat right before the meltdown. Again, we line fireplaces with bricks because they don't conduct heat; that is not to say they don't absorb heat. In these rich towns, many of the families have a cushion to keep them from a month to month meltdown, but many of their steep monthly nuts might just give them so many gallons of oil in their emergency generator and that might just run out abruptly, it just might take until the end of that tank. That brick will eventually get hot, it just takes longer... |

|

| Back to top |

|

|

GenXer

Joined: 20 Feb 2009

Posts: 703

|

Posted: Wed Feb 25, 2009 5:24 pm GMT Post subject: Posted: Wed Feb 25, 2009 5:24 pm GMT Post subject: |

|

|

Teavo: Do you know 100% that you will not be struck by lighting? You don't. You simply assume that your chances of that are small. Well, what if you do NOT KNOW what your chances are? Then will you still say that taking a chance is BETTER than flipping a coin? How can you be sure? What if your chances are 60:40, and a coin flip is only 50:50?

Let us not get too arrogant with knowledge. We don't always know enough to make even an educated guess. Sometimes it is better to say, "I don't want to play that game because I DO NOT KNOW MY CHANCES".

Moreover, the outcome of sports and quantum mechanics has been shown to be 'nice' randomness, much like a coin flip. However in a game with HUGE payoffs or losses happening with a LOW probability the stakes are much higher. Just because we do NOT understand randomness doesn't mean we should continue our risky behavior as if the risk of losing a coin toss is the same as a risk of losing a job, a house and becoming bankrupt.

Are you SURE that your prediction will be even REMOTELY close to the real events? What is your estimation error? If I had to guess, it is much larger than you realize. If everything lended itself to nice and bounded solutions we wouldn't BE in this mess. So please, let us learn humility and let us not jump with claims about our prediction abilities which are ludicrous at best.

Sometimes it is better to just accept that we are clueless and not do something. Sometimes it is better to be passive, and save us from ourselves. |

|

| Back to top |

|

|

Guest

|

Posted: Wed Feb 25, 2009 5:26 pm GMT Post subject: Posted: Wed Feb 25, 2009 5:26 pm GMT Post subject: |

|

|

| JCK wrote: | No. You misunderstand my argument. My argument is primarily that drawing lines on a graph is a terrible, terrible way to make a prediction. That's why I absolutely despise those sorts of graphs. Please draw a graph with the last five years removed, draw a similar line (based on the five years before that) and tell me how predictive that line is.

There are many reasons to believe prices will drop in the near future, and I'm not arguing against that premise. I am arguing, however, that these sorts of graphs have no predictive value whatsoever, and only serve to mislead, rather than educate.

You don't know how quickly or slowly prices are going to decline, even if we accept that they are. That graph implies that we have some idea of the timeframe or the extent of the decline, which we simply do not. |

I agree that extrapolating lines at the end of graphs is not the best way to make predictions. However I think you may have misunderstood the import of that graph. I didn't post it (StallionMang did) but the lesson I take from it is not the extrapolation at the end of the curve (the dotted line) which is what seems to be bothering you.

Forget the dotted line at the end. It's not especially important. It only shows what a return to the mean could look like. But it's not the main message.

The lesson to learn from that graph is the rough historical value of homes in the USA going back to 1890. It's a benchmark. It tells us that something is really odd about the years 2000-2006. It tells us that prices in that period flew way above their historical norms.

By itself that does not ensure any future outcome, but it is certainly evidence to suggest that home prices are abnormally high, and therefore more likely to fall than rise further.

I think that's the point Professor Shiller was trying to make with that graph as well (it's his graph, not including the dotted line). |

|

| Back to top |

|

|

GenXer

Joined: 20 Feb 2009

Posts: 703

|

Posted: Wed Feb 25, 2009 5:37 pm GMT Post subject: Posted: Wed Feb 25, 2009 5:37 pm GMT Post subject: |

|

|

Guest: Even though this may happen, we do not know when or how, or even IF the prices 'revert' to some historical norm. Mean reversion has not been shown to work, at least as of today, when we try to predict the future based on the results from the past. Period. Anything else would be random guesses. Prices might come down below this 'norm', or they may stay above it, in any case, I think it is MORE likely that a new 'norm' will be the NORM in the future, above or below the current one. This is why this chart is MISLEADING at best, as it assumes that

1) Mean reversion is real

2) We can predict the magnitude and the time scale of it, which we can not

I can doodle a chart and I'll be probably more correct in my 'prediction' than this chart. |

|

| Back to top |

|

|

|

|

You can post new topics in this forum

You can reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

|

Forum posts are owned by the original posters.

Forum boards are Copyright 2005 - present, bostonbubble.com.

Privacy policy in effect.

Powered by phpBB © 2001, 2005 phpBB Group

|