|

bostonbubble.com

Boston Bubble - Boston Real Estate Analysis

|

|

SPONSORED LINKS

Advertise on Boston Bubble

Buyer brokers and motivated

sellers, reach potential buyers.

www.bostonbubble.com

YOUR AD HERE

|

|

DISCLAIMER: The information provided on this website and in the

associated forums comes with ABSOLUTELY NO WARRANTY, expressed

or implied. You assume all risk for your own use of the information

provided as the accuracy of the information is in no way guaranteed.

As always, cross check information that you would deem useful against

multiple, reliable, independent resources. The opinions expressed

belong to the individual authors and not necessarily to other parties.

|

| View previous topic :: View next topic |

| Author |

Message |

Guest

Guest

|

Posted: Fri Mar 10, 2017 2:37 am GMT Post subject: Posted: Fri Mar 10, 2017 2:37 am GMT Post subject: |

|

|

New construction condos in Boston (BB, SE, BH) start about $1300 / sf.

I agree that if there's a bust, the working class communities will see the biggest

price correction.

The desireable towns didn't get that big price drop everyone was hoping for 8 years ago, and I suspect it won't happen during the next downturn. |

|

| Back to top |

|

|

Former Arlingtonian

Joined: 23 Oct 2013

Posts: 141

|

Posted: Mon Mar 13, 2017 12:41 pm GMT Post subject: Mortgage rates Posted: Mon Mar 13, 2017 12:41 pm GMT Post subject: Mortgage rates |

|

|

Why this time may be different....but, no one really knows

ITS ALL ABOUT RATES!

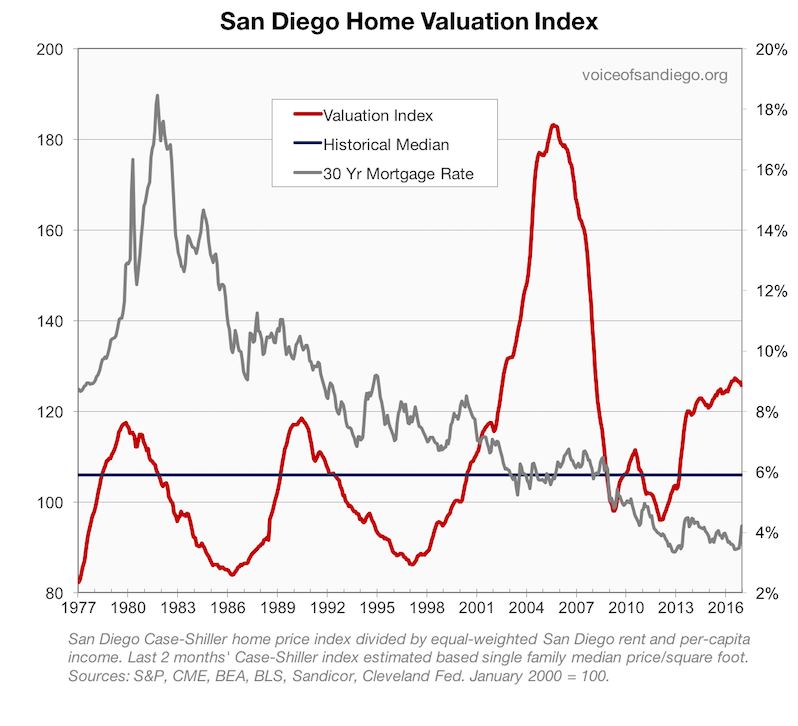

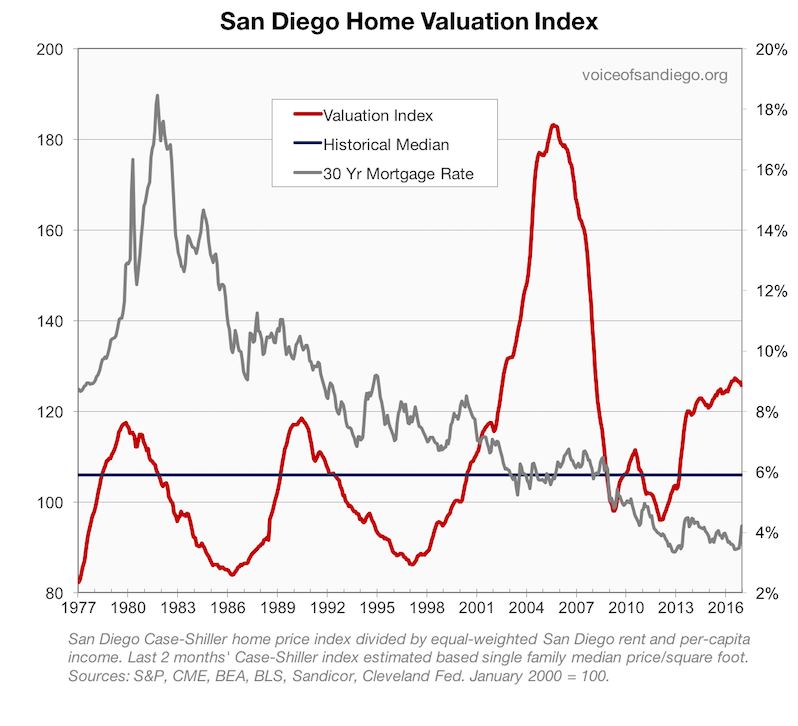

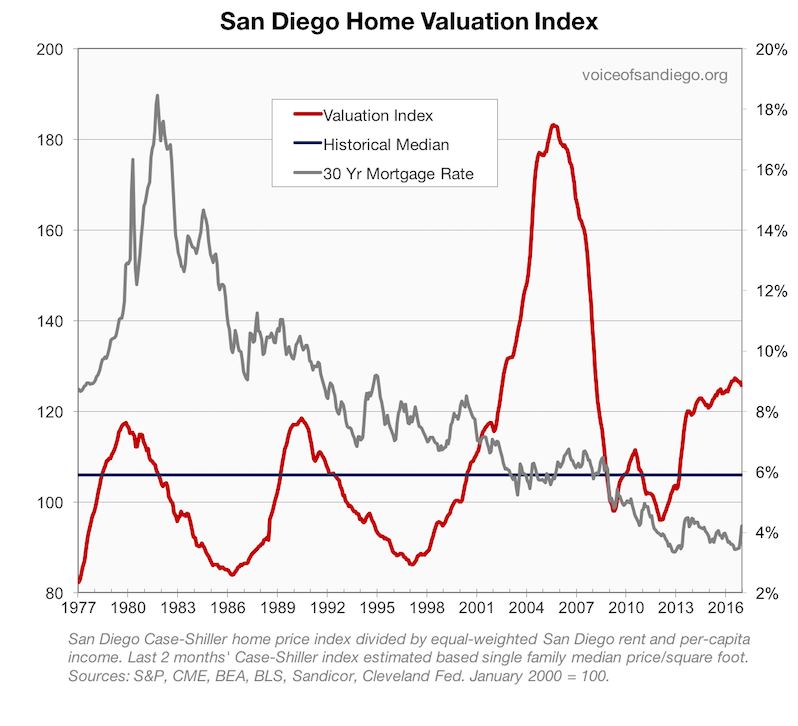

Here is a great graphic on San Diego real estate vs mortgage rates - yes, its not just Boston area real estate that has been going up thanks to 3% Mortgage rates

|

|

| Back to top |

|

|

Guest

|

Posted: Mon Mar 13, 2017 6:37 pm GMT Post subject: Re: Mortgage rates Posted: Mon Mar 13, 2017 6:37 pm GMT Post subject: Re: Mortgage rates |

|

|

| Former Arlingtonian wrote: | Why this time may be different....but, no one really knows

ITS ALL ABOUT RATES!

Here is a great graphic on San Diego real estate vs mortgage rates - yes, its not just Boston area real estate that has been going up thanks to 3% Mortgage rates

|

Its really hard to decide how to interpret those numbers. Could it mean:

Americans can tolerate average payments up to $2000 (or average of $1474). That would mean the bubble has some leeway to sustain until rates make the average payment to $1474.

That would imply rates back to 8% or "american could tolerate up 8%" based on historical averages. I would predict 3-4 years before rates could get back to 8% |

|

| Back to top |

|

|

Guest

|

Posted: Mon Mar 13, 2017 6:49 pm GMT Post subject: Interest rates Posted: Mon Mar 13, 2017 6:49 pm GMT Post subject: Interest rates |

|

|

The Fed is again hinting it will raise interest rates…but maybe not based on their past history...25% which is not very much. Will this affect prices, inventory, sales? I guess we'll know soon with the "spring market" upon us.

It seems the mantra in the press is that higher prices are somehow a good thing, yeah, for sellers and people who got "in" many years ago.

Savers will continue to be punished as the rate increase of .25% will take a long time (if ever) to be reflected in bank savings accounts. There is no reward for being responsible and staying out of debt.

So happy we bailed out the big banks after 2008 so they certainly don't have to suffer! Let the little guy suffer a bit longer I guess! |

|

| Back to top |

|

|

Guest

|

Posted: Mon Mar 13, 2017 6:50 pm GMT Post subject: Posted: Mon Mar 13, 2017 6:50 pm GMT Post subject: |

|

|

Sorry, that should say 0.25%.  |

|

| Back to top |

|

|

Guest

|

|

| Back to top |

|

|

admin

Site Admin

Joined: 14 Jul 2005

Posts: 1826

Location: Greater Boston

|

Posted: Tue Mar 14, 2017 3:08 pm GMT Post subject: Re: Mortgage rates Posted: Tue Mar 14, 2017 3:08 pm GMT Post subject: Re: Mortgage rates |

|

|

| Anonymous wrote: | | The better news is that we will see negative rates for the first time in the US and record low mortgage rates again. |

That's possible, but there are some things which would prevent it. My first thought it that declining rates would likely require inflation to remain under control. That could be thwarted through consumer price increases arising from protectionism and the undoing of globalization. Substantially increased deficit spending for an infrastructure overhaul and military expansion might also increase inflationary pressures.

- admin |

|

| Back to top |

|

|

Guest

|

Posted: Tue Mar 14, 2017 3:44 pm GMT Post subject: Posted: Tue Mar 14, 2017 3:44 pm GMT Post subject: |

|

|

We will NOT see dramatic rate up hike, because we are still deeply in debt as a nation, and we are still can not stop borrowing from other nations.

FED will raise the rate 3 or 4 times, with minimum amount each time. And then that will be it.

What Trump try to do currently to reverse U.S. as in debt nation are the following:

1. In stead of being the world's policeman, U.S. will become the world's biggest weapon merchant. By doing so, we cut cost from deploying and maintaining solders oversea, and we increase profit by selling products made in U.S.A. Awesome plan I have to say!

2. Revert obamacare, cut healthcare benefit from senior and low income groups. Another cost cutting move. It is inhuman, but who care about the old and poor?

3. Lower tax for big companies, hoping more investing/hiring activities from top down. This is kind of reminds me who caused the financial meltdown back in 2008 in the first place. Are those the same groups will be rewarded again?

4. Big infrastructure rebuilt. Which is putting money within the country, cause more jobs and better country in the long run. He is learning from China of this. Another great idea I think. The best of all is, his family business will be greatly benefited from it.

The hopeful plan is, once these 4 major steps take affect in coming years, which should effectively lowering our national debt to certain level, then we are ready to manipulate rate upward for channel in all the fortunes from the world. This will take years.

There is always a possibility of black swan event that could cause rate hike much sooner and much higher. I already mentioned before in other posts, this black swan must related to the credibility of American dollar. In order to protect the credibility of the green back, and if that meant hiking rate and destroying the housing market, so be it.

For now, we seat back, Invest some in military, infrastructure, oil; and we wait. |

|

| Back to top |

|

|

Guest

Guest

|

Posted: Thu Mar 16, 2017 2:17 am GMT Post subject: Posted: Thu Mar 16, 2017 2:17 am GMT Post subject: |

|

|

| I do think Trump's plans will forestall a recession, but it will explode the national debt. |

|

| Back to top |

|

|

admin

Site Admin

Joined: 14 Jul 2005

Posts: 1826

Location: Greater Boston

|

Posted: Thu Mar 16, 2017 12:01 pm GMT Post subject: Posted: Thu Mar 16, 2017 12:01 pm GMT Post subject: |

|

|

| Guest wrote: | | I do think Trump's plans will forestall a recession, but it will explode the national debt. |

Almost by definition, higher national debt means higher interest rates, relative to what they otherwise would have been.

- admin |

|

| Back to top |

|

|

Guest

|

Posted: Thu Mar 16, 2017 3:20 pm GMT Post subject: Posted: Thu Mar 16, 2017 3:20 pm GMT Post subject: |

|

|

| Quote: | | Almost by definition, higher national debt means higher interest rates, relative to what they otherwise would have been. |

Admin, isn't your saying of higher national debt means higher interest rates counterintuitive?

For the last 9 years, we saw interest rate going downward, while our national debt simply just can not stop growing upward.

We see now the intention of Trump administration to unwind the upward trend of our national debt, while FED try to do these symbolic mini rate hikes. Is this clearly indicating National debt and interest rate should be on the opposite direction of movement, in order to keep U.S. economy in a healthy shape? |

|

| Back to top |

|

|

admin

Site Admin

Joined: 14 Jul 2005

Posts: 1826

Location: Greater Boston

|

Posted: Thu Mar 16, 2017 4:00 pm GMT Post subject: Posted: Thu Mar 16, 2017 4:00 pm GMT Post subject: |

|

|

Treasuries are the national debt, and they are also the benchmark for interest rates. By the law of supply and demand, if you offer more of something, the price falls. Offering more Treasuries (increasing the debt) should lead to lower prices (relative to where they would have been), and lower prices necessarily mean higher yields / interest.

I would guess that the last nine years saw demand for US debt grow faster than supply, hence falling rates / rising prices. Lower rates were not a result of higher debt - lower rates occurred in spite of it, and for separate reasons. My point is, rates would have been even lower had the national debt not increased.

- admin |

|

| Back to top |

|

|

Guest

|

Posted: Fri Mar 17, 2017 12:58 pm GMT Post subject: Posted: Fri Mar 17, 2017 12:58 pm GMT Post subject: |

|

|

| admin wrote: | Treasuries are the national debt, and they are also the benchmark for interest rates. By the law of supply and demand, if you offer more of something, the price falls. Offering more Treasuries (increasing the debt) should lead to lower prices (relative to where they would have been), and lower prices necessarily mean higher yields / interest.

I would guess that the last nine years saw demand for US debt grow faster than supply, hence falling rates / rising prices. Lower rates were not a result of higher debt - lower rates occurred in spite of it, and for separate reasons. My point is, rates would have been even lower had the national debt not increased.

- admin |

Admin is absolutely right. US 10 yr treasury rates should have been under 1% and 30 year mortgage rates should have been under 2.5% if not for the higher debt. With the Republicans in control, the debt will not grow as quickly and we will set record low rates when the next recession hits. |

|

| Back to top |

|

|

|

|

You can post new topics in this forum

You can reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

|

Forum posts are owned by the original posters.

Forum boards are Copyright 2005 - present, bostonbubble.com.

Privacy policy in effect.

Powered by phpBB © 2001, 2005 phpBB Group

|